Table of Contents

- Tariff_Chart

- what is a tariff 4 - The Adventures of Accordion Guy in the 21st Century

- Tool Bag HS Code | In Different Countries | A Comprehensive List

- Tariff Graph

- Tariff Definition & Image | GameSmartz

- Tariff Clipart Sun - vrogue.co

- What Is a Tariff? Definition and Guide - Shopify

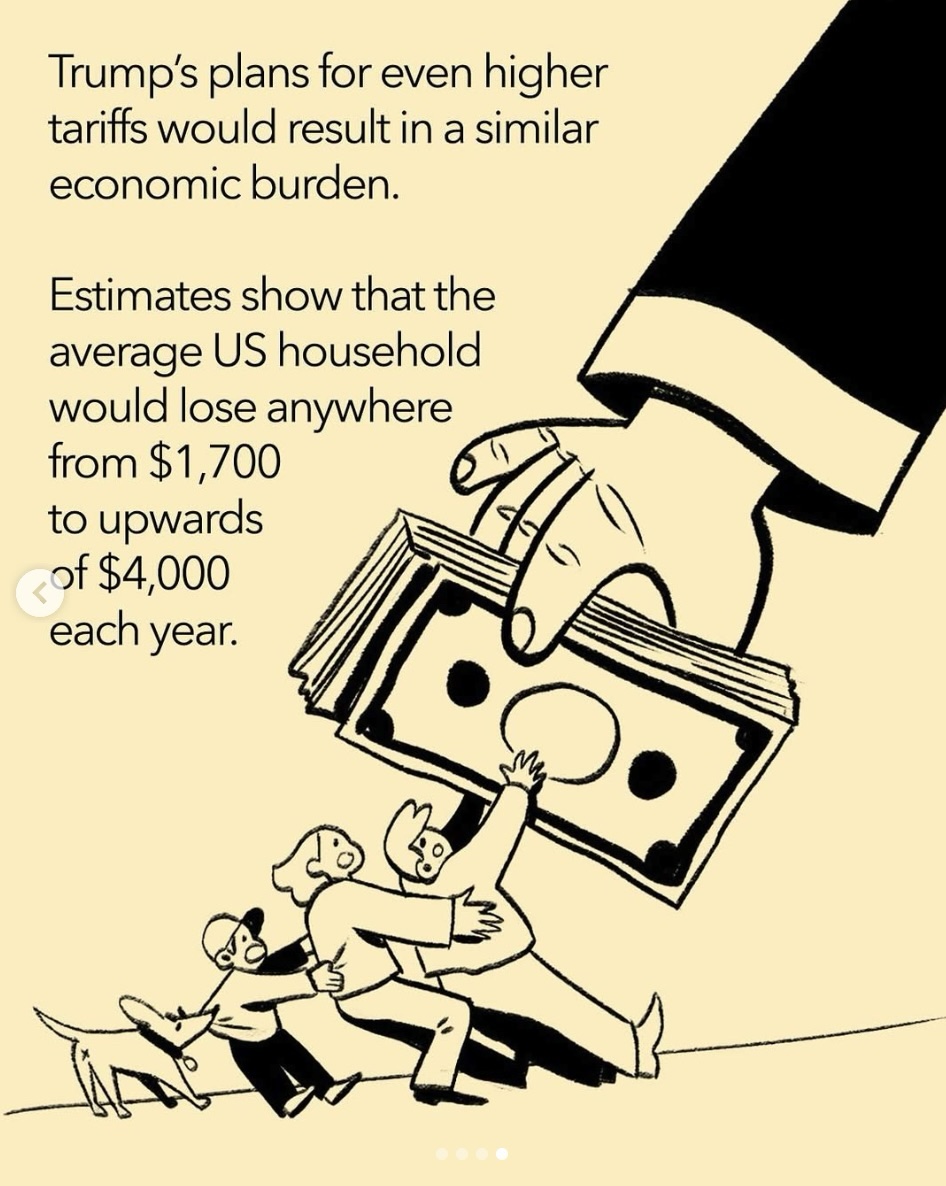

- Trump tariffs explained: Where things stand with Mexico, Canada, China

- Tariffs

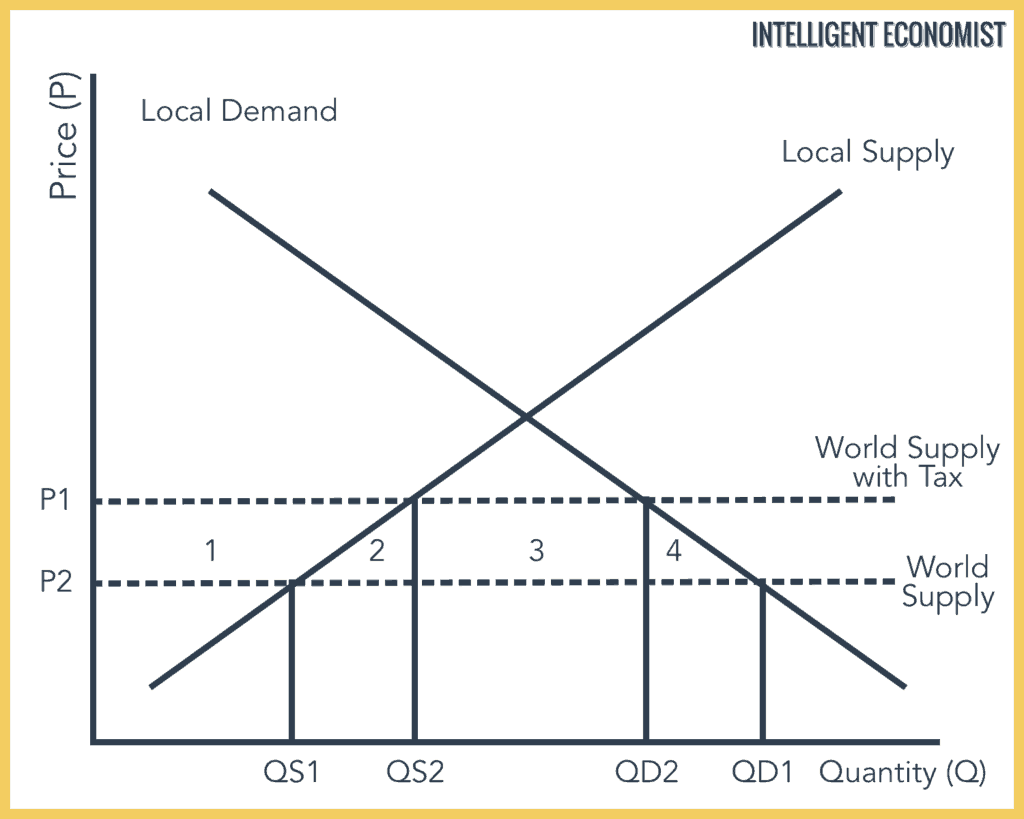

- Tariff Graph

What are Tariffs?

Types of Tariffs

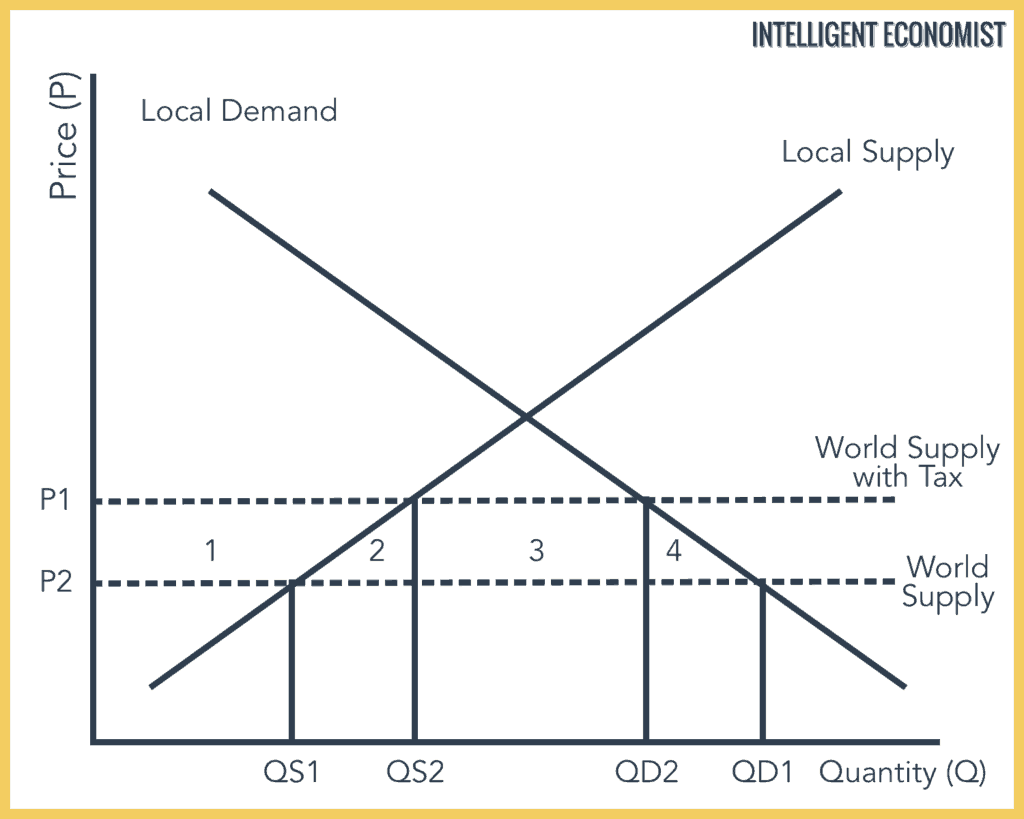

How Do Tariffs Work?

When a country imposes a tariff on an imported good, the importer must pay the tariff amount to the government before the good can be released into the market. The tariff amount is typically calculated based on the value of the good, and is usually paid by the importer. For example, if a country imposes a 10% ad valorem tariff on imported cars, an importer would have to pay 10% of the value of the car as a tariff. If the car is worth $10,000, the importer would have to pay $1,000 in tariffs.

Purpose of Tariffs

Tariffs serve several purposes, including: Protecting domestic industries: Tariffs can help protect domestic industries by making imported goods more expensive and less competitive. Generating revenue: Tariffs can generate significant revenue for governments, which can be used to fund public goods and services. Regulating trade: Tariffs can be used to regulate trade and prevent unfair trade practices, such as dumping.